Centerra South campaign continues; developer touts net gain from existing development

LOVELAND — The next public meeting to discuss the proposed Centerra South development in Loveland won’t be until April 4, but work continues in the background to persuade decision-makers that the project will be worth the costs.

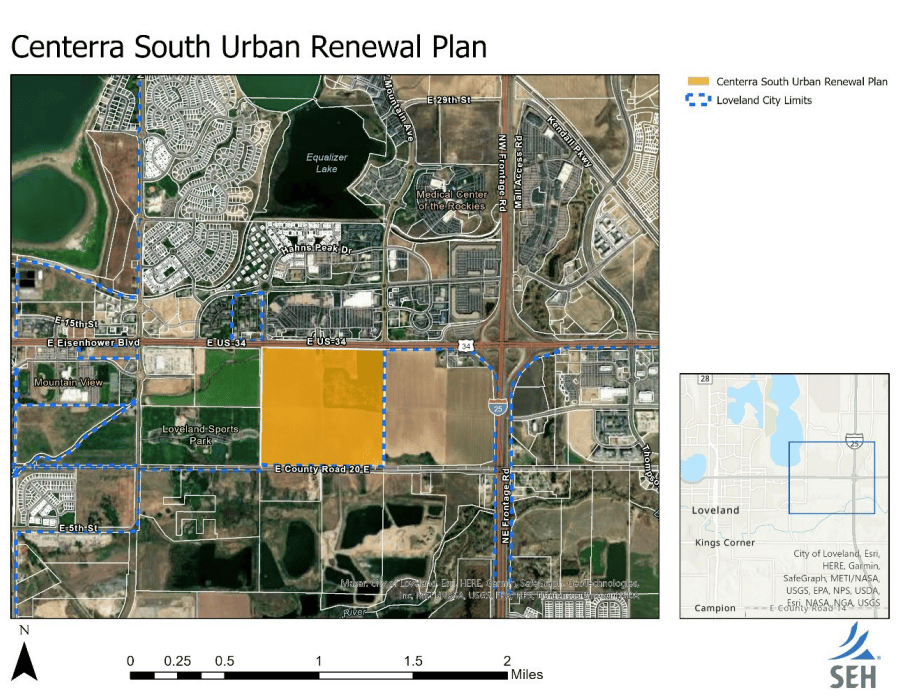

Underway are negotiations with other taxing authorities, including Larimer County, the Thompson School District and special taxing districts that would be affected by the financial terms of creating a new urban renewal authority to help finance the $86.9 million of infrastructure in the development, which is located on 140 acres of land south of U.S Highway 34 (Eisenhower Boulevard) and south of the existing Centerra development.

Urban renewal authorities take increases in property and sales taxes caused by a development — the tax increment — and apply those taxes to pay interest and principal on bonds used to build public infrastructure. Base taxes such as those collected prior to development continue to be applied to taxing districts as they were before.

The negotiating step is new under Colorado law, which requires that taxing entities not only be consulted but have representation on the URA board and agree to the terms of the financing agreement.

State law says that the entities “shall meet and attempt to negotiate an agreement.” Further, “in the absence of an agreement … parties must submit to mediation.”

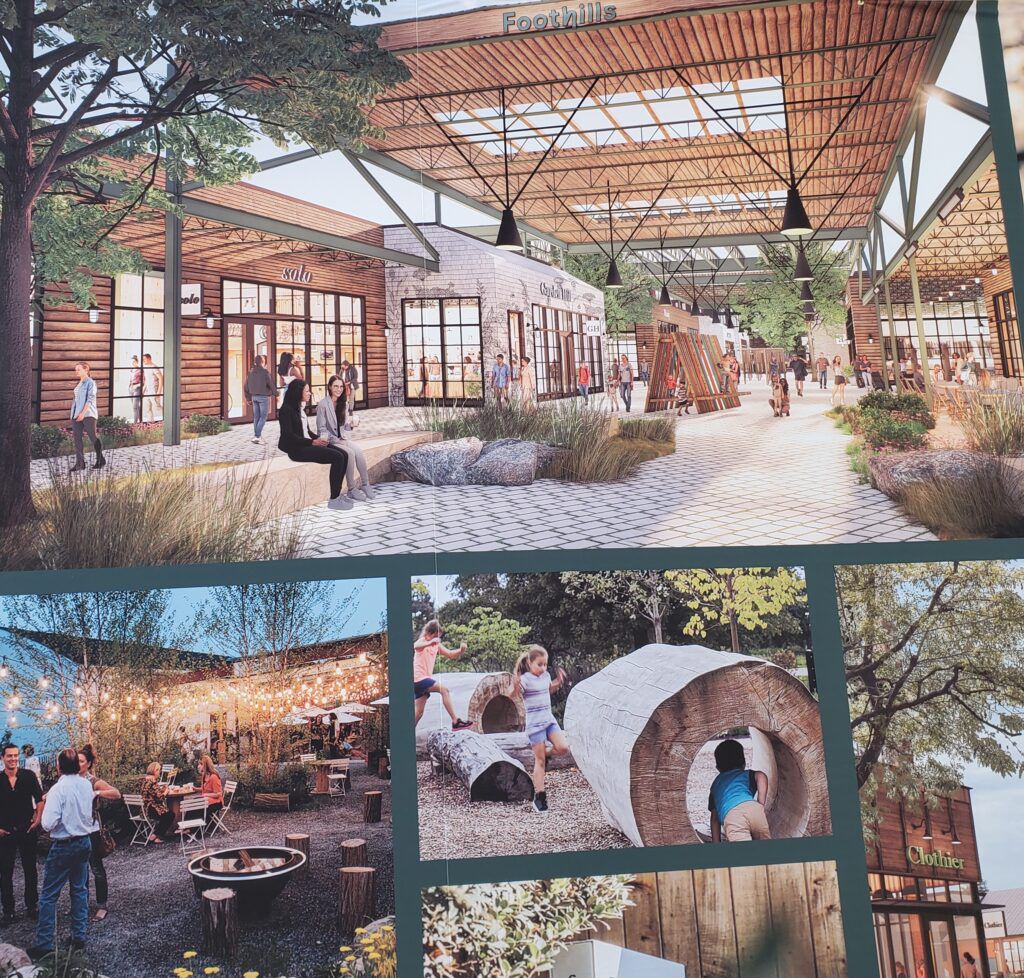

The developer’s plans include commercial structures (including a grocery store) to be built adjacent to Eisenhower, with residential set farther to the south on the nearly quarter section plot of land.

The development would include 298,000 square feet of commercial space, plus 1,075 housing units, most of which will be multifamily and duplex units.

To date, McWhinney Real Estate Services Inc. has touted the benefits of the development as adding to the 8,500 jobs already created in Centerra and the addition of more businesses along with what it calls “attainable” housing.

McWhinney documents have said new assessed value from Centerra South will be about $65 million, annual property taxes paid to the city will be $823,000 and $47 million would be paid in sales taxes over 25 years at the 1.75% tax rate that it is proposing in a master financing agreement. The other part of the city sales tax — 1.25% — would go toward the infrastructure.

McWhinney, which will host a “community conversation” on March 22 from 5-7 p.m. at the Hub community center in Centerra’s Kinston, has also hired a national real estate firm to assess the fiscal impacts of the existing Centerra development.

Development Planning & Finance Group, with offices in California, Texas, North Carolina and Florida, wrote in the analysis that the existing Centerra, not including parcels not yet developed, generates $12.6 million in recurring annual revenues for the city, annual recurring costs of $8.96 million and a net fiscal surplus of $3.7 million.

As noted in the analysis, sales tax revenues attributable to Centerra include purchases made by Centerra residents outside of Centerra, where the full 3% city sales tax rate is collected. Revenues also include lodging taxes, taxes such as gas and cable franchise taxes that are shared with local governments, motor vehicle sales and use tax distributions, and other revenue streams that would not have resulted without the existing Centerra development.

Recurring costs, according to the analysis, include increased costs for each city department — such as police services — that would not have occurred without Centerra.

“The results of this report are meant to reflect a typical year based on averages,” the authors said. The report did not account for inflation.

Source: BizWest